News

Understanding the Impact and Future of Biden’s Student Loan Policies

For millions of Americans, the issue of student loan debt has been a major concern. Through a variety of student loan measures, President Joe Biden’s administration has made tremendous progress in resolving this situation. We will examine the effects of Biden’s student loan measures in this post as well as potential future ramifications for borrowers. Let’s analyse how these policies. Which range from loan forgiveness and income-driven repayment plans to improvements in loan servicing, seeking to lessen the burden of student loans and promote a more accessible and fair higher education system.

Section 1: Overview of Biden’s Student Loan Policies

In order to ease the financial burden on borrowers, President Biden has proposed a number of student loan measures. The growth of income-driven repayment programmes. Set monthly payment ceilings depending on borrowers’ income levels, is one of the primary goals. The administration has also suggested widespread student loan forgiveness, focusing on particular demographics including teachers, public workers, and low-income individuals. To better serve borrowers, efforts have also been made to streamline the loan forgiveness procedure and enhance loan servicing.

Section 2: Impact of Biden’s Student Loan Policies

Biden’s student loan policies have two effects. The growth of income-driven repayment plans, for starters, enables borrowers to make manageable monthly payments based on their income, lowering the risk of default and providing assistance to those in need. With this modification, borrowers will have greater financial freedom to take care of other pressing requirements without feeling overburdened by their student loan commitments.

Second, the proposed student loan forgiveness programmes could help thousands of borrowers who are struggling with debt. The administration aims to recognise people who have dedicated their careers to serving the public good by focusing on certain categories like public employees and teachers. In addition to providing financial relief to qualified borrowers, this strategy encourages careers in public service, filling key gaps in fields that are crucial to society.

Section 3: Future Implications and Challenges

Biden’s student loan policies have received a lot of support, but they also have drawbacks and long-term effects. The cost and viability of universal student loan forgiveness are two issues to be worried about. Critics claim that programmes for loan forgiveness could unfairly favour high-income borrowers, potentially leading to a moral hazard. The government continues to face a lot of difficulty striking a balance between the need for relief and fiscal sustainability.

These policies’ passage is questionable because they depend on Congress’s agreement for execution. Political opposition and discussions about funding sources make the process even more challenging. Finding practical answers is crucial because of the potential benefits to the economy as a whole and the financial well-being of borrowers.

Biden’s student loan policy may change the face of higher education in the future. The government wants to increase college accessibility and promote enrollment. And lessen overall student debt by putting a priority on cheap education. The expense of higher education may also be reevaluated as a result of these regulations. And universities may be encouraged to take steps to reduce student loan debt.

Conclusion

A big step has been taken to solve the growing student loan crisis in the US with President Biden’s student loan policies. The administration aims to lessen the financial burden on borrowers and promote a more equal higher education system by extending income-driven repayment arrangements and suggesting loan forgiveness programmes. The possibility of universal forgiveness and gaining congressional backing are still issues, though. Despite the challenges, these policies have the potential to change the way student loans operate in the future and improve access to and affordability of education for future generations.

News

SRN News Top of the Hour: Navigating the News Landscape with Precision and Style

In today’s world of nonstop news and information, it’s more important than ever to keep up. With updates at the top of the hour, SRN News is an excellent resource for current events. Let’s take a look at how the pros at SRN convey the news and maintain their listeners’ interest.

The Significance of Timely News

Timely news is more than simply information in today’s fast-paced world; it’s a tool for making informed choices. Keeping abreast with current events keeps people in touch with what’s going on in the world and helps them make better decisions.

SRN News Format

SRN takes a novel approach by providing updates on the hour, keeping its audience informed all day long. The format features reports on a wide variety of news topics, from politics to pop culture.

The Art of Storytelling

SRN’s ability to deliver engaging stories is one of its main selling points. Each report is written like a gripping story to attract readers and make the content more approachable.

Perplexity in News Reporting

Reporting the news requires a delicate balancing act between detail and clarity. SRN does this by providing seemingly incomprehensible information in a way that is both captivating and informative.

Burstiness in News Delivery

SRN’s rapid updates are evidence of the rapid pace at which news is being disseminated nowadays. The public is kept updated despite the platform’s emphasis on speed, as high-quality content is consistently sent.

The Human Touch in Reporting

SRN uses tales and personal experiences to humanise the news and create a stronger bond between the network and its viewers. This human element differentiates SRN from impersonal news sources.

Navigating Information Overload

SRN’s audience benefits from the constant stream of information since the network provides updates that are both brief and thorough. SRN helps individuals make sense of the overwhelming amount of data by guiding them through the noise.

Utilizing Analogies and Metaphors

By drawing on parallels and metaphors, SRN makes the news more accessible. This method improves comprehension and makes even complicated stories more approachable.

The Role of Rhetorical Questions

SRN frequently asks rhetorical questions to stimulate viewers’ analytical thinking. This not only increases engagement, but also makes people reflect more thoroughly on the news they take in.

SEO Optimization in News Writing

Optimisation for search engines is essential for online exposure in the modern day. By include appropriate keywords, SRN makes its information searchable and hence more accessible to internet readers.

Crafting Unique Headlines

SRN’s attention-grabbing headlines are guaranteed to stand out. Balancing the necessity for SEO optimisation with reader appeal, the platform ensures its headlines are both attractive and useful.

The Active Voice in News Writing

Using the active voice improves the readability and directness of news articles. SRN uses this method to keep its audience on the edge of their seats and well informed.

Conclusion

SRN News provides its audience with news in a fresh and compelling way with its hourly updates. SRN differentiates itself in the crowded news market by focusing on narrative, complexity, brevity, and humanity.

FAQ’s

- How does SRN ensure the accuracy of its news updates?

To guarantee the reliability of its news reports, SRN employs a multi-step fact-checking procedure.

- What sets SRN’s storytelling apart from other news sources?

Storytelling on SRN is characterised by a human touch, with reporters and anchors using tales and personal experiences to make the news more accessible and interesting.

- How does SRN balance complexity and simplicity in its news reporting?

Without losing context or clarity, SRN manages to communicate complex material in a way that captivates its audience.

- Why is the active voice important in news writing?

News reports are more effective and interesting when written in the active voice, which increases clarity and urgency.

News

Raven Richard Channel 9 News: A Journey of Influence and Dedication

In the field of journalism, the name Raven Richard is synonymous with reliability, honesty, and commitment. She has risen to prominence on Channel 9 News thanks to her command of the English language, knack for reporting, and natural flair for delivering the news. The journalist Raven Richard has made an everlasting effect on the media world, and this essay will examine her life and work.

Early Life and Education

The journalistic career of Raven Richard has solid beginnings. She had a rural upbringing that fostered her love of literature and storytelling. After finishing her high school education, she sought a degree in journalism from a prestigious institution, where she refined her writing and reporting talents.

Raven Richard’s Journey to Channel 9 News

After finishing college, Raven Richard began a fantastic career in journalism. Beginning as an intern, she gained experience in all aspects of journalism from reporting to newscasting. Her hard work and commitment were recognised, and she was offered a position at Channel 9 News.

Accomplishments and Achievements

Raven Richard has accomplished much throughout his time at Channel 9 News. She has been recognised for her excellent coverage of pressing problems and breaking news. People love her because she can relate to them and they can trust the facts she gives them.

Raven Richard’s Reporting Style

Raven Richard’s engaging and polished English is one of the things that sets her reporting apart. Her reporting has a conversational tone that makes difficult subjects easier to understand. This style keeps viewers engaged and appeals to a wide variety of people who can now follow the news.

Impact on the Community

Raven Richard goes beyond her reporting duties by actively connecting with the community. She actively takes part in community outreach activities because she is convinced of the transformative potential of journalism. Her commitment to making a change is inspiring.

Challenges Faced in the Field

Raven Richard, like any other successful person, has had to overcome obstacles in her pursuit of journalism. Her will to succeed in her field has only grown as a result of these setbacks. She has surmounted challenges and adjusted to the ever-changing world of news reporting.

Covering Memorable News Stories

Throughout her career, Raven Richard has reported on a wide variety of groundbreaking news items. She has been in the vanguard of reporting on everything from natural catastrophes to political events, keeping the public informed at all times.

Raven Richard’s Work Ethic and Dedication

Raven Richard’s hard work and determination have helped her become where she is now. To assure the credibility of her reporting, she goes above and beyond. Her audience have come to trust her since she always tells it like it is.

Community Engagement and Outreach

The value of having strong ties to one’s neighbourhood is something that Raven Richard fully appreciates. She is well-liked in the area since she frequently takes part in activities and programmes that help to strengthen these bonds.

The Future of Raven Richard at Channel 9 News

Channel 9 News has a bright future with Raven Richard as she continues to advance in her profession. She will almost certainly be given additional responsibility in the newsroom in the near future, further establishing her as a leader among journalists.

A Day in the Life of Raven Richard

Have you ever been curious about a day in the life of Raven Richard? Her days are jam-packed with commitments such as meetings, interviews, and study. She is very good at scheduling her time so that she can provide excellent news coverage.

Raven Richard’s Hobbies and Interests

Raven Richard, in addition to her busy professional life, enjoys a wide variety of activities in her spare time. She maintains equilibrium through a variety of activities, including reading, travelling, drawing, and volunteering.

The Viewer’s Perspective

Audiences see more than simply a newsreader in Raven Richard. She provides them with up-to-date information and is always a pleasant presence. Her audience finds common ground with her work, making her an indispensable part of their life.

Conclusion:

Raven Richard’s rise to fame at Channel 9 News is a reflection of her perseverance, diligence, and superior journalistic abilities. She has risen to prominence in the media industry and made an indelible mark on her hometown.Keep up with Channel 9 News to learn about the newest developments and hear from Raven Richard. Raven Richard has always been an inspiration to her fellow journalists because to her polished news delivery and ability to hold the attention of her viewers with insightful analysis.

FAQ’s

1. How did Raven Richard start her career in journalism?

Raven Richard began her journalism career as an intern at a local news channel, eventually gaining a position at Channel 9 News.

2. What sets Raven Richard’s reporting style apart?

Raven Richard’s reporting has a natural, conversational tone that makes even difficult subjects easier to understand.

3. What are some of Raven Richard’s notable achievements in journalism?

Raven Richard’s outstanding coverage of vital problems and breaking news items has earned her several accolades.

4. How does Raven Richard engage with the community?

Raven Richard shows her dedication to make a difference in the world by taking part in a variety of outreach programmes and activities.

5. What can viewers expect from Raven Richard in the future?

There’s hope for Raven Richard at Channel 9 News, where she might rise to even greater prominence in the future.

News

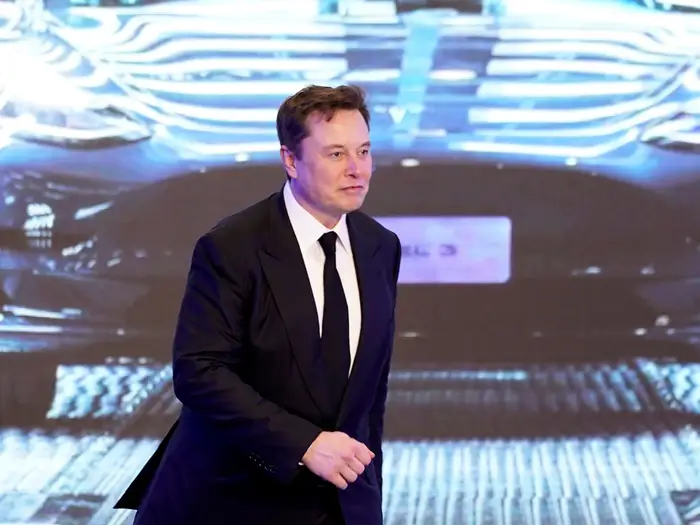

Elon Musk’s Tesla Full Self-Driving (FSD): Revolutionizing the Automotive Industry

With his ground-breaking electric automobiles, Elon Musk. The brilliant businessman and CEO of Tesla Inc., has been at the vanguard of revolutionising the automotive sector. Full Self-Driving (FSD) technology is one of the most important innovations that Tesla has introduced. This essay examines Elon Musk’s Tesla FSD’s amazing potential, present situation, and prospective effects on transportation in the future.

What is Tesla Full Self-Driving (FSD)?

Tesla’s Full Self-Driving (FSD) technology for autonomous driving intends to make it possible for cars to run without the need for driver input. To traverse highways, make difficult judgements. And react to varied driving circumstances, FSD combines cutting-edge technology, such as cameras, radar, ultrasonic sensors, and powerful onboard processors, with artificial intelligence algorithms.

Current Status of Tesla FSD

With a small group of early access consumers as of 2023, Tesla’s Full Self-Driving technology is still in the beta testing stage. Through over-the-air updates, accumulating useful driving data from real-world situations . And optimising the algorithms, the business has been enhancing the software regularly. FSD delivers a number of cutting-edge driver-assistance functions, including as Autosteer, Traffic-Aware Cruise Control, and Auto Lane Change, despite the fact that it is not yet fully autonomous.

Benefits and Potential Impact

The Tesla FSD by Elon Musk has the potential to transform the car industry in a number of ways. Here are some significant advantages and possible effects:

1. Enhanced Safety: The goal of FSD is to lessen human error. Which is the main factor in most accidents, using cutting-edge sensors and AI algorithms. It might possibly save countless lives since it can analyse and react to traffic conditions more quickly than a human driver.

2. Improved Traffic Efficiency: FSD technology has the ability to improve overall traffic efficiency. Lessen stop-and-go traffic, and reduce congestion to optimise traffic flow. This may lead to shorter travel times, better fuel economy, and a more environmentally friendly transportation system.

3. Increased Accessibility: For people who are unable to drive owing to disability or age-related restrictions, autonomous cars enabled by FSD may offer mobility options. Additionally, it could improve the mobility alternatives available to those living in rural regions or without access to dependable public transit.

4. Ride-Sharing and Mobility-as-a-Service: Tesla vehicles with FSD capabilities might revolutionise the ride-sharing market. Tesla automobiles with autonomous capabilities might be requested using a smartphone app, offering practical and affordable transportation choices. This may open the door for Mobility-as-a-Service (MaaS) business models, lowering automobile ownership and urban congestion.

Challenges and Future Outlook

Tesla’s Full Self-Driving technology still has many difficulties to overcome despite its enormous promise. The limits of the present hardware and software must be overcome, as well as regulatory obstacles and public acceptance. Furthermore, maintaining the privacy and security of driverless cars is a crucial challenge.

Looking ahead, Tesla will continue to make significant investments in R&D to improve FSD capabilities. As the FSD beta programme grows and more Tesla owners use it, the firm intends to progressively increase the technology’s availability.

Conclusion

Tesla Full Self-Driving technology developed by Elon Musk has the potential to completely change the way we travel by moving us closer to a day when all cars are autonomous. Although FSD is still in the early stages of research. Its potential advantages are astounding, including higher safety, better traffic efficiency, expanded accessibility. And game-changing ride-sharing models. The continual focus on innovation and development by Tesla raises hopes for the advent of completely autonomous vehicles.

-

Fashion6 months ago

Fashion6 months agoHow To Style Earrings for a Night Out

-

Real Estate1 year ago

Real Estate1 year agoHow to Unlock the Benefits of Real Estate Investment in Pakistan

-

Tech11 months ago

Tech11 months agoTMIIS Virtual Gateway: Opening New Horizons in Global Connectivity

-

Business2 months ago

Business2 months agoWhat Can You Expect from a High-End London Office Space?

-

Digital Marketing2 months ago

Digital Marketing2 months agoHow to calculate CPM in digital marketing?

-

Lifestyle12 months ago

Lifestyle12 months agoThe New Trend in Home Furnishings Teapoy and Wooden Sitting Stool

-

Digital Marketing6 months ago

Digital Marketing6 months agoA Step-by-Step Guide To Become A Cyber Security Architect

-

Real Estate1 year ago

Real Estate1 year ago5 Common Mistakes to Avoid When Buying Property in Pawleys Island, SC